Woodard & Company’s “golden rule” sums up their philosophy of how they do business—”Always buy quality and diversify.”™

Their fundamental premise for investment is trademarked and is foundational to the way Woodard & Company has operated since 1985. A registered investment advisory firm, Woodard & Company Asset Management Group, Inc., is led by John Woodard. As fiduciaries, he and his team offer fee-only discretionary investment portfolio management. Together, they bring decades of expertise to their clients, who have entrusted them with the management of their assets. “Our approach,” said John, “is summed up by our fundamental premise—”Always buy quality and diversify,” which means applying an investment discipline incorporating quality investments that are diversified, based on the client’s objectives and risk tolerance in the context of the timeliness of the underlying economic circumstances and opportunities.

So, what does it mean to “Always buy quality and diversify?”

Relative to their stock portfolio, John explained, “Let’s start with quality. Quality matters. It matters in everything, from what we eat, what we wear, and most definitely to how we invest our money.” In their stock portfolio called “Market Leaders,” for example, the team looks for quality investments which are generally industry leaders. If a company is the leader of a specific industry group, they typically are able to recruit and retain the best and brightest management, and generally these stocks have strong balance sheets, A healthy balance sheet typically gives them the resources for R&D, acquisitions, and the opportunity for expansion, both domestically and overseas. In the stock portfolio they manage, the securities they look for are blue-chips with long-term records for outstanding performance. When managing assets, they want to select the best quality for their core holdings.

“When we utilize high-quality investments” continued John, “we typically reduce the overall risk; we know of the investments’ past performance and expectations for the future, and that helps as useful information from which to build our financial framework. It’s all about making informed decisions.”

John continued, “We take the approach in our investments of a principled, disciplined strategy. This method has served us well as we work together in a team-focused environment. We’re collectively looking for the good for our clients. We all have a vested interest in their financial success. That starts with quality from our investment choices and is manifested through the quality service our team is committed to giving with every client.”

The Woodard & Company motto also emphasizes the importance of diversifying. “We know it’s never a good idea to put all the eggs in one basket. For example—if all your investments are concentrated in one industry or one individual company, it may work out for you, but it can also be a complete disaster. In our stock portfolio, for example, we are generally ‘sector-neutral’ to the S&P500, which means a certain percentage of the portfolio, relative to the weighting in the S&P500 Index weighting, is invested in, for example, financials, technology, healthcare, etc. Diversifying among various sectors can compensate for underperformance of certain asset classes, sectors, or industries. Appropriate diversification actually lowers the overall risk of investment, because diversification generally enables portfolios to overcome a variety of economic conditions and timeframes.”

John went on to say, “Just as our investments are chosen based on quality, we also choose our diversification based on defined disciplines, portfolio theory, and what we perceive as optimal potential for achievement. With diversification, over the long-term we feel we can manage the risks based on our client’s expectations. We can be either aggressive or conservative.”

“We are fiduciaries, which means we hold the client’s interests first. The client gives us an overview of their objectives, needs, resources, and risk parameters, and based on that information, we act upon a continuous and discretionary basis to invest and manage their assets. Woodard and Company does not sell or broker any investments—we are fee-only. Therefore, as fiduciaries we are on the same side of the table as our clients, always acting in their best interests. Our clients appreciate being able to turn over their investment portfolio to a trusted source, which to a great extent eliminates the worry and concern of making day-to-day investment decisions.”

“The biggest part of the equation, though,” John concluded, “is that we will always hold the clients’ interests first. I really can’t emphasize that enough. Our success starts with their success, and to that point, we are committed to doing what is best for our clients. Our clients have entrusted us with assets approaching $1 billion; we have managed investment portfolios since 1985, and we don’t take that trust for granted.”

Woodard & Company is a singularly focused asset management company that takes what it does seriously. “We stick with what we do really well,” said John. “We do not sell insurance, annuities, or mutual funds. Instead, we focus on the market and the economy, finding that by being focused on asset management gives us a greater strength in our niche. We are eager to help individuals, families, and even businesses—putting their money to work in smart, proven, and reliable ways that yield the biggest return possible.”

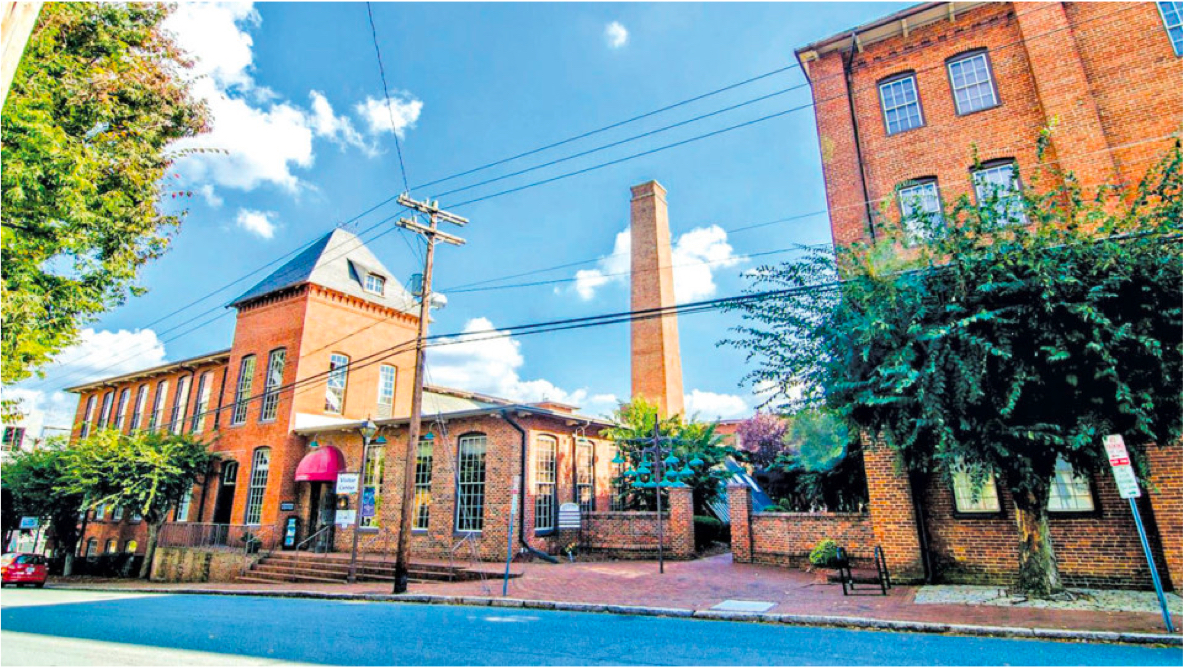

Woodard & Company Asset Management is located at 117 Kinderton Boulevard in Bermuda Run. Call the office at 336.998.7000 or visit online at WCAMG.com. Also, be sure to like them on Facebook!

[SIDEBAR # 1]

Joan Woodard serves as the Chief Financial Officer of Woodard & Company, but her passion is the community. “We have partnered with some incredible organizations,” Joan said. “The Salvation Army, The Davie Community Foundation, Hospice, churches, and Little Leagues throughout Forsyth and Davie counties. We love supporting causes and organizations we believe in. We believe in the adage, ‘To whom much is given, much is expected.’ Our company believes in giving back and supporting a variety of organizations through financial giving and philanthropy, but also through time, talent, and volunteerism.”

“One of our favorite projects,” Joan continued, “Is the “Hands & Hearts” event with the Salvation Army and “Sounds of Summer” for Davie Community Foundation. Each one is their major fundraiser, and we have been the lead sponsors of the events. It’s something we look forward to supporting, because we value and appreciate what they do to make our community a better place.”

The Woodards have lived in Davie County for over 20 years; on their 250-acre farm, they have raised Angus beef cattle and small grain crops. Living on a farm and raising their son in that environment had been a dream for years. Father and son and sometimes Mom all work together taking care of the animals—cows, horses and even chickens, as well as planting corn and soybeans, working and playing together.

John and Joan have been very active in their community serving on various boards, both institutional and charitable.

John and Joan met when they both worked in the same building, John at E F Hutton & Co and Joan at a CPA firm. In 1985, John started Woodard and Company Asset Management and after several years as an accountant and Controller at Douglas Battery Manufacturing, Joan joined him at Woodard and Company.

[SIDEBAR # 2]

The Woodard & Company mission includes:

- Philosophy: “Always buy quality and diversify.”

- Disciplined Investment Strategy: “Tactical Asset Allocation.”

- Informed Decisions: Made through the company’s own research and based on their investment strategy.

- Trust: Clients have entrusted Woodard & Company to manage assets approaching $1 billion since 1985. We hold the client’s interests first.

- Teamwork: Investment decisions made by committee.

- Uncompromised Personal Service: Valuing individual relationships with clients.